27+ claiming mortgage interest

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

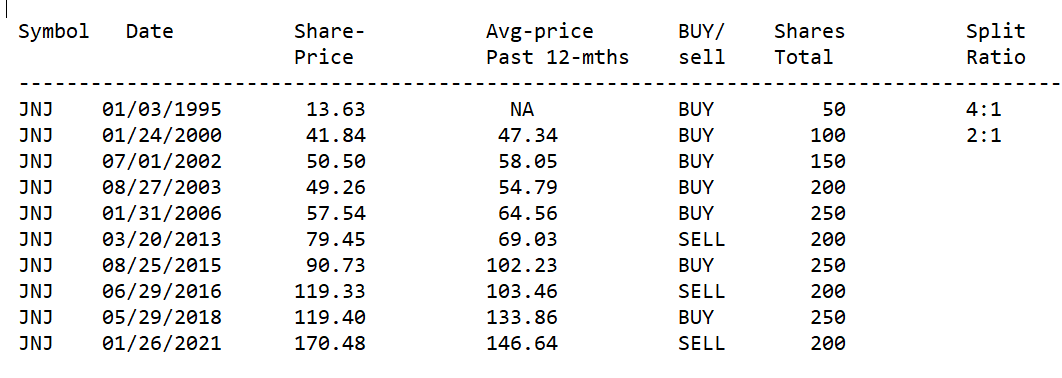

How To Build Wealth Buy Low And Sell High Consistently Seeking Alpha

Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

. Web If your home was purchased before Dec. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

The co-owner is a spouse who is on the same return. Filed a General Tax- Tax case against 728 Georgia Avenue Corp. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

How Much Interest Can You Save by Increasing Your Mortgage Payment. Web There are different situations that affect how you deduct mortgage interest when co-owning a home. Web Taxpayers who took out a mortgage after Dec.

Web Heres how to claim the mortgage interest deduction. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Your mortgage lender is required to provide a 1098.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Those who filed tax returns with under. Web The most recent IRS data show few low- and middle-income taxpayers benefit from the home mortgage interest deduction.

Enter the full amount as it. You may still be able to. Web The answer is that you can only claim the deduction for the interest you actually paid.

The terms of the loan are the same as for other 20-year loans offered in your area. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file.

You paid 4800 in. Find A Lender That Offers Great Service. For taxpayers who use.

Web Nyctl 2021-A Trust And The Bank Of New York Mellon As Collateral Agent And Custodian et al. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately of. Use Form 1098 to report mortgage.

However due to the Tax Cuts and Jobs Act the amount you can claim may be reduced. Web You can claim your Mortgage Interest on your home. Compare More Than Just Rates.

Web The IRS has lots of rules and guidelines to claiming the mortgage interest tax deduction. Well outline the basics here. For mortgages taken out after.

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. You can deduct the interest on your mortgage on up to 1.

So if each person paid 50 of the mortgage each person is only eligible to. Mortgage interest is claimed on Schedule A Line 8.

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Robert Scaglione Mortgages

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Tax Tips And Tidbits The Harlem Valley News

Robert Scaglione Mortgages

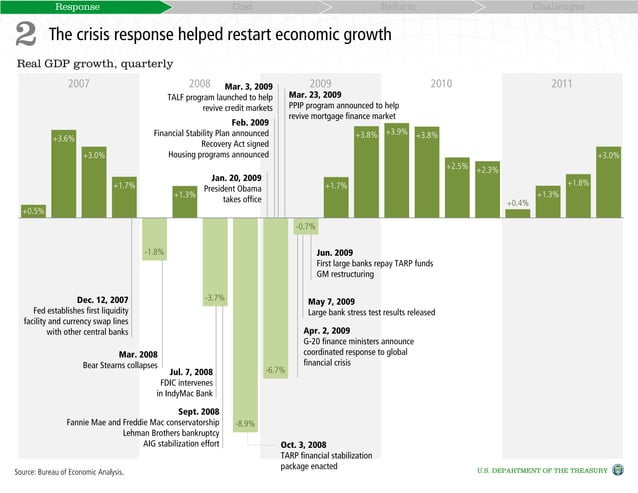

Response Cost Reform Challenges 2

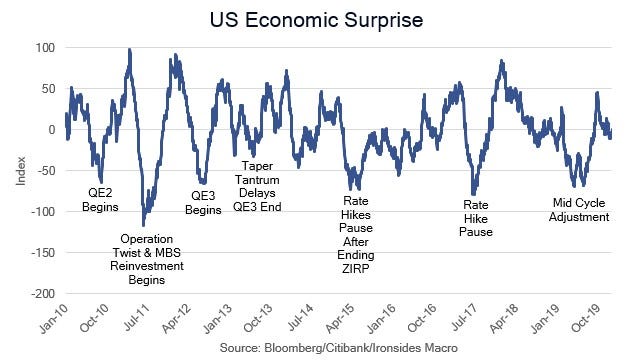

The Third Variable By Barry Knapp

Robert Scaglione Mortgages

Mortgage Interest Deduction Bankrate

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Buy To Let Mortgage Interest Tax Relief Explained Which

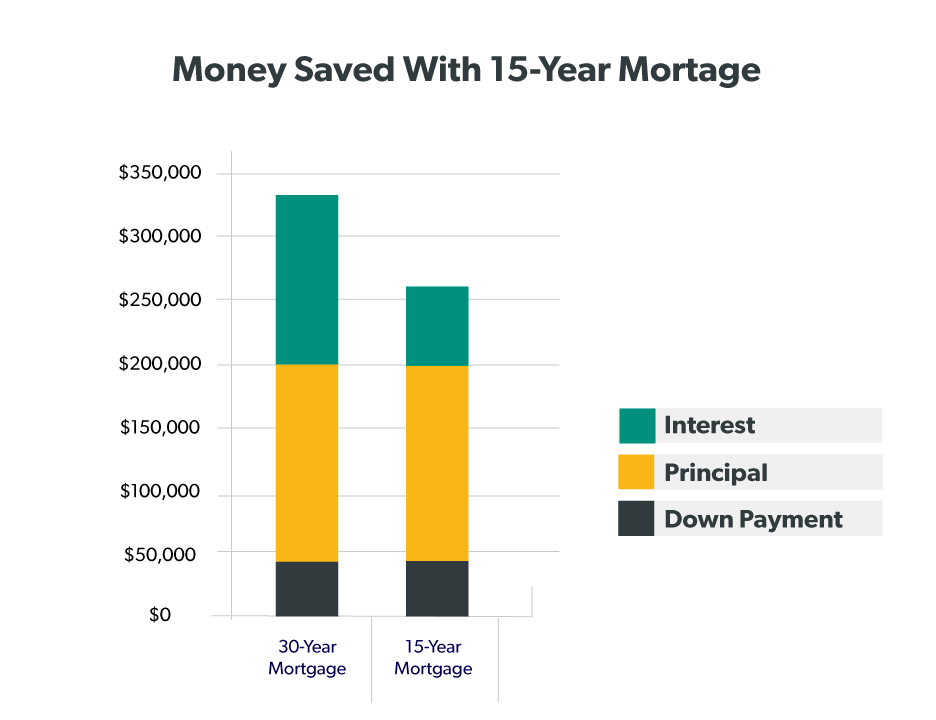

Mortgage Comparison 30 Year At 4 75 Vs 15 Year At 3 75 My Money Blog

What Is A 30 Year Fixed Rate Mortgage Ramsey

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Mortgage Interest Deduction Rules Limits For 2023

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Save When Filing Your Taxes